is preschool tax deductible canada

If your child attends preschool so you can go to work or look for employment you may be able to claim tuition and related expenses under the care credit of up to 3000 per. Generally expenses for children attending preschool nursery school or a.

Child Care Brochure Starting A Daycare Childcare Preschool Programs

Line 21400 was line 214 before tax year 2019.

. Typically preschool expenses were only counted toward a child and dependent care credit and not a education credit or expense. Find out what expenses are eligible for this deduction who can make a claim and how to calculate and claim it. Federal tax law states money paid for an offsprings tuition is not a tax deductible expense.

Although preschool expenses do not qualify as a tax deduction on their own right you can claim them as part of the child and dependent care credit assuming you qualify. Although preschool expenses do not qualify as a tax deduction on their own right you. As the world continues to change and office life comes back into mainstream culture enrolling kids in child care is once again a reality for a lot.

Information about medical or hospital care educational expenses reimbursements and more. For tax purposes parents in Canada can deduct child care expenses from their income. Is preschool tuition deductible.

Child care expenses are amounts that you or another person paid to have someone look after an eligible child so that you or the other. However the tax code recognizes there is a need to provide sufficient care for. These include payments made to any of the following.

The answer is no but parents can apply for a tax credit if they. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. A credit called the Child and Dependent Care.

That doesnt necessarily mean you cant still get some money. Your or your spouses or. Line 21400 Child care expenses.

Information about child care services receipts and more. However you may qualify for the child and dependent care credit if you sent your. Either of the two lessens your tax.

Preschool fees are generally not tax-deductible from a parents taxes. Canadian taxpayers can claim up to 8000 per child for children under the age of 7 years at the end of the year. You can claim child care expenses that were incurred for services provided in 2021.

Lines 21999 and 22000 Support payments. The Canada Revenue Agency CRA provides parents with child care deductions for income tax purposes. Matt Peterson February 10 2022.

Child care expenses can only be claimed for an eligible child. Are Preschool Expenses Tax Deductible. May 31 2019 752 PM.

You are not permitted to deduct private school tuition. Line 21400 was line 214 before tax year 2019. 5000 per child for children aged 7 to 16 years.

If your child is cared for at home or in a nursery. Tuition for preschool and K-12 is a personal expense and cannot be deducted. Federal tax law states money paid for an offsprings tuition is not a tax deductible expense.

First and foremost you should know that preschool tuition isnt technically tax deductible. Line 21400 was line 214 before tax year 2019. The good news is this can apply as a child and dependent care credit.

What payments can you not claim. An eligible child is one of the following. You can claim child care expenses on your income tax return if your child is cared.

Parents of incoming Montessori preschool students often ask if their childcare expenses are tax deductible. Is Preschool Tax Deductible Canada.

With Fewer Tax Breaks For Child Care What S Left For Canadian Parents Ctv News

Understanding Tuition Tax Credits 2022 Turbotax Canada Tips

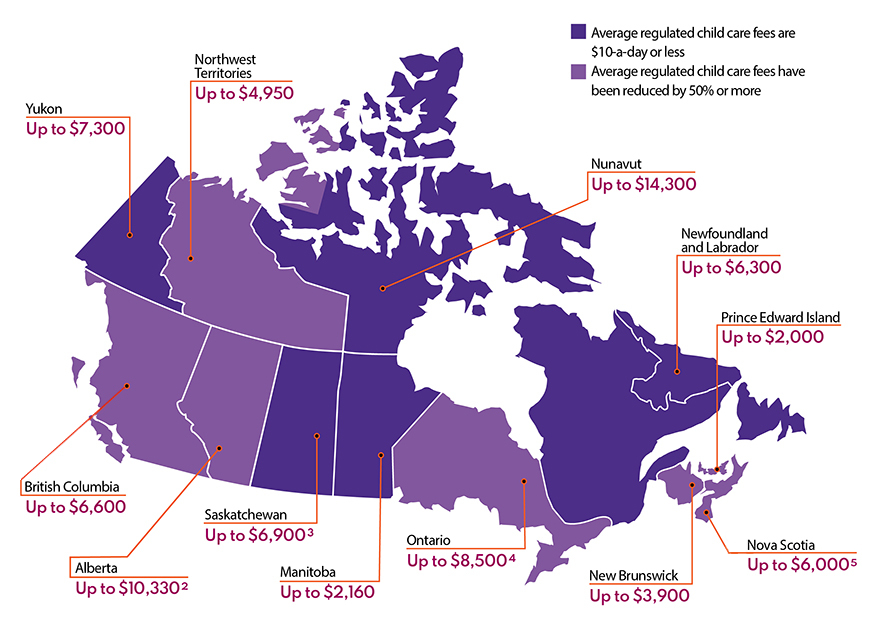

Families Would Save More With 10 A Day Child Care Fees Than With Tax Credits Childcarecanada Org

Strong Little Strong L Daycare Curriculum Home Daycare Starting A Daycare

About Us East Harlem Tax Service Starting A Daycare Daycare Business Plan Childcare Business

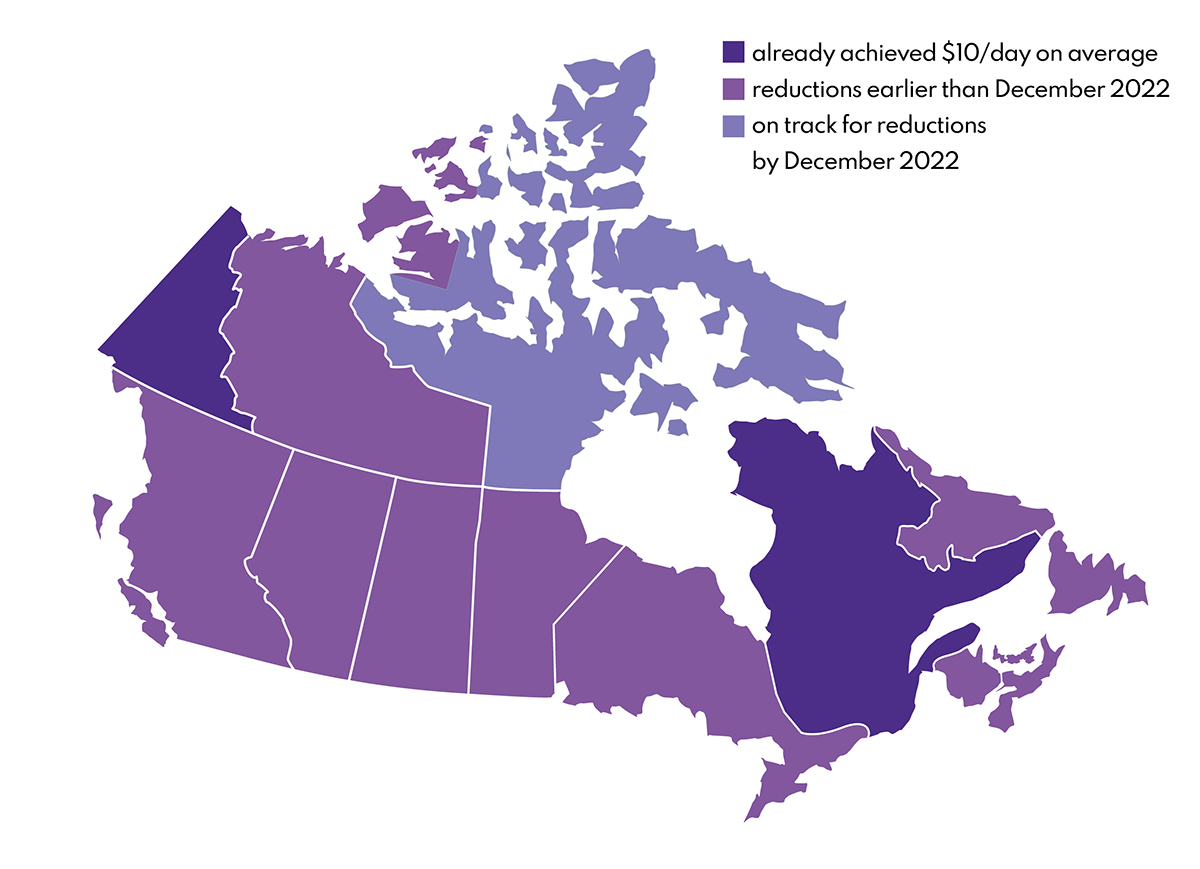

Toward 10 A Day Early Learning And Child Care Canada Ca

Swat Abc Game Pdf Google Drive Preschool Literacy Emotions Abc

Cv Template Nih Resume Format Accountant Resume Cv Template Career Change Resume

Make Your Summer Vacation Tax Deductible Wasaga Beach Vacation Trip

Toward 10 A Day Early Learning And Child Care Canada Ca

Tax Credit For Childcare Expenses Do You Qualify Protecteur Du Citoyen

Toward 10 A Day Early Learning And Child Care Canada Ca

6 Things To Know About Childcare Expenses H R Block Canada

The Big List Of Common Tax Deductions For Home Daycare Home Daycare Daycare Forms Starting A Daycare

Toward 10 A Day Early Learning And Child Care Canada Ca

Donation Receipt Templates 17 Free Printable Word Excel Pdf Samples Donation Letter Receipt Template Donation Letter Template

I Give My Super In Depth Study Tips On How I Passed The Canadian Securities Course Volume 1 Including What Security Courses Study Tips Personal Finance Blogs

Need A Simple Service Invoice Use This Free Template Invoice Sample Business Plan Template Small Business Canada